Argentina

San Juan province is the leading gold producer and the most pro-mining province in Argentine Republic. The geological potential of the province is backed by a proactive Mining Ministry and strong governmental support. In addition to a number of producing gold mines San Juan Province hosts world class copper deposits such as El Pachón (Glencore), Los Azules (McEwen Mining) and El Altar (Stillwater Mining).

San Juan province is the leading gold producer and the most pro-mining province in Argentine Republic. The geological potential of the province is backed by a proactive Mining Ministry and strong governmental support. In addition to a number of producing gold mines San Juan Province hosts world class copper deposits such as El Pachón (Glencore), Los Azules (McEwen Mining) and El Altar (Stillwater Mining).

Hualilan Gold Project

600koz at 12g/t gold in a well known mining district – earning 75% #

The Hualilan Project consists of 15 mining leases and an exploration licence application covering the surrounding 26km2. Hualilan has extensive historical drilling with in excess of 150 drill-holes dating back to the 1970s. The property was last explored by La Mancha Resources, a Toronto Stock Exchange listed company, in 2004. La Mancha’s work resulted in NI43-101 (non-JORC) resource estimate of ~647,000 Oz Au at 12 g/t gold# that remains open in most directions.

The most recent metallurgical work (1999-2000) indicated 80% recoveries of gold and silver via a simple flotation operation plus production of a ~ 50% zinc concentrate stream.

# historical NI43-101 (non-JORC Code compliant) resource estimate

(Source La Mancha Resources Toronto Stock Exchange Release May 14, 2003 – Independent Report on Gold Resource Estimate)

Location and Access

The Hualilan Project is located approximately 120km north-northwest of San Juan, the capital of San Juan Province in north-western Argentina.

Logistics are excellent with the Project accessible via sealed roads to within 500 metres of the licence and then by a series of unsealed roads around the licence. The closest town on the power grid is approximately 40km to the north of the Hualilan Project.

The project is located at an elevation of approximately 1700m. The climate is moderate and dry with rain most common from December to January. The area is sparsely populated, vegetation is thin and geology is well exposed at surface. Field operations are possible year-round.

Geology and Mineralisation

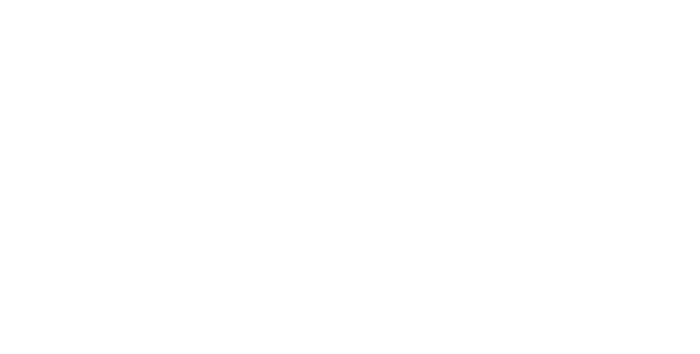

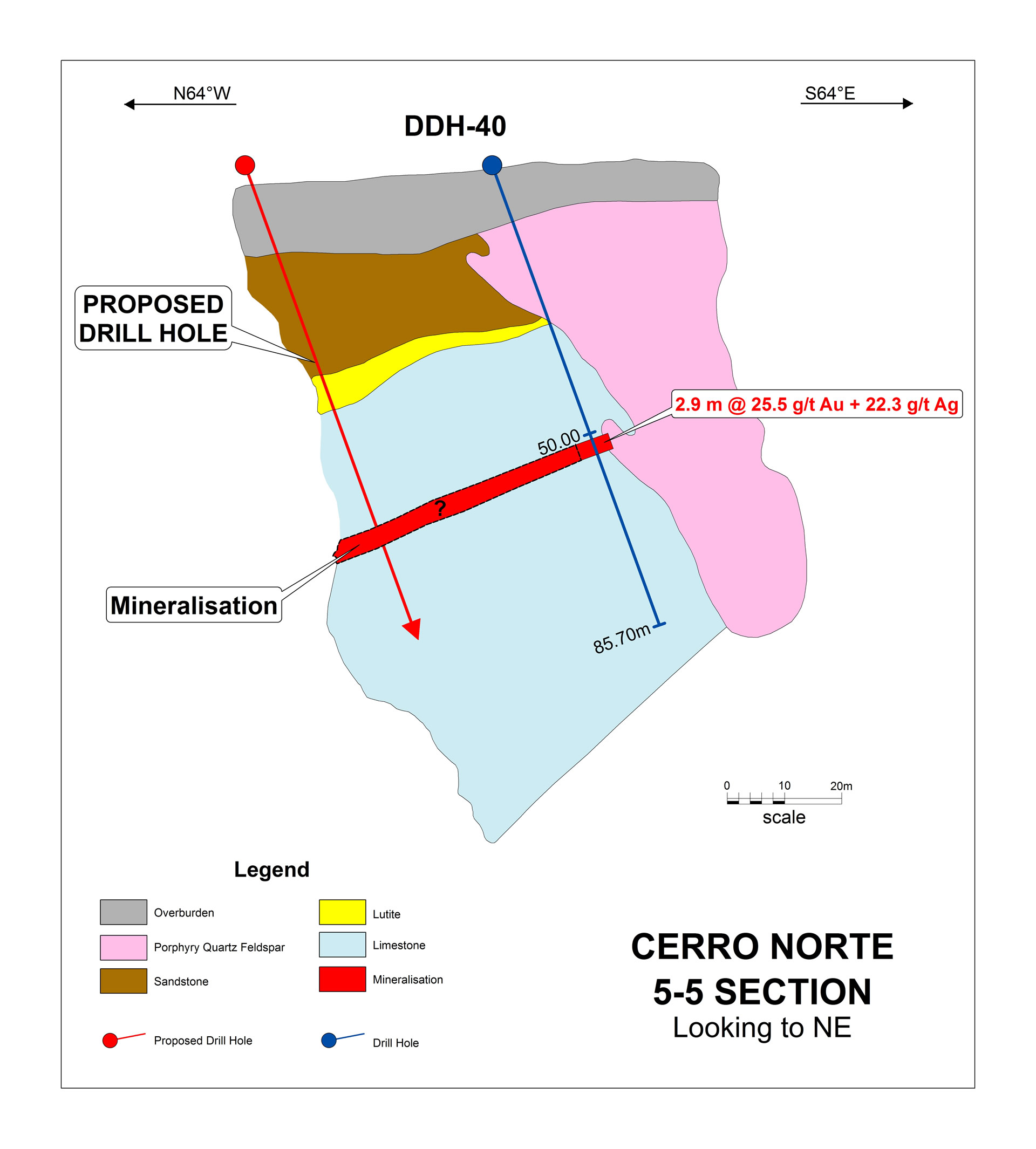

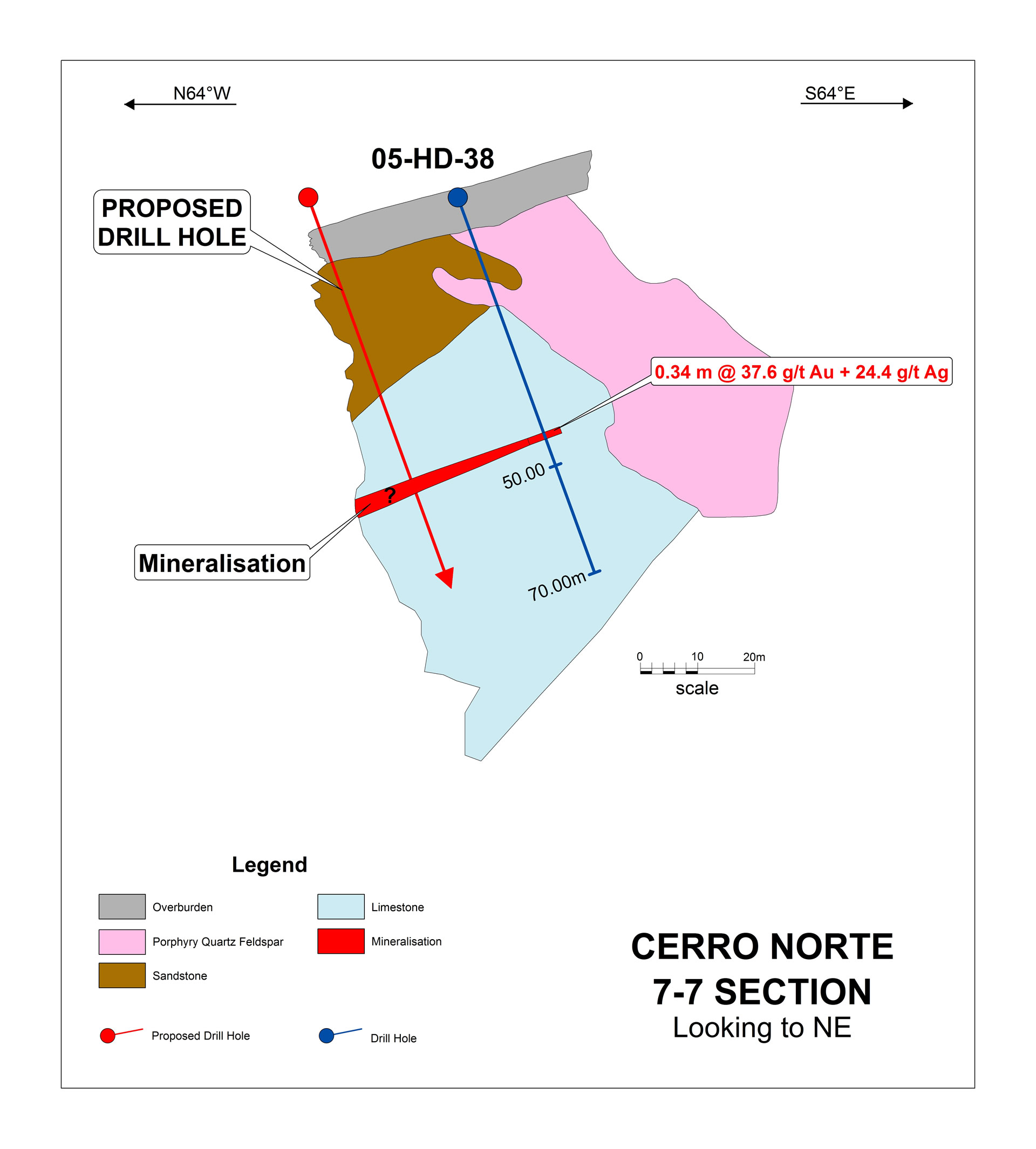

The host rocks to the known mineralisation are Ordovician limestone and Silurian conglomerate, sandstone and siltstone. The sedimentary rocks are intruded by mid-Miocene stocks, dykes and sills.

The mineralisation consists of two sub-vertical orthogonal sets of mineralisation which have thicknesses of 1 to 4 m. Mineralisation is controlled by steeply dipping east-west faults and north-south steeply dipping bedding. The faults were the conduit for mineralising fluids from the intrusives. Where the mineralising solutions migrating up the faults intersected permeable limestone beds the mineralisation traveled outwards replacing the limestone forming mantos.

The mineralisation has been classified as manto-style (distal skarn) with vein-hosted mineralisation. Gold occurs in native form, in tellurides (hessite) and as inclusions with pyrite and chalcopyrite. The mineralisation also commonly contains chalcopyrite, sphalerite and galena.

The mineralisation has been identified in a number of vein and manto bodies covering approximately 5km of strike which remain open in most directions. Historical exploration has been limited to areas where the deposit outcrops.

The key historical exploration drilling and sampling results are listed below.

Exploration

Intermittent sampling dating back over 500 years has produced a great deal of data including sampling data, geologic maps, reports, trenching data, underground workings, drill hole results, geophysical surveys, resource estimates plus property examinations and detailed studies by several geologists although no work has been completed since 2006.

- 1984 – Lixivia SA channel sampling & 16 RC holes (AG1-AG16) for 2040m

- 1995 – Plata Mining Limited (TSE: PMT) 33 RC holes (Hua- 1 to 33) + 1500 samples

- 1998 – Chilean consulting firm EPROM (on behalf of Plata Mining) systematic underground mapping and channel sampling and resource estimate

- 1999 – Compania Mineral El Colorado SA (“CMEC”) 59 core holes (DDH-20 to 79) plus 1700m RC program and resource estimate

- 2003 – 2005 – La Mancha (TSE Listed) undertook 7447m of DDH core drilling (HD-01 to HD-48) and resource estimate

In addition to 188 historical drill holes there is 6km of underground workings that pass through mineralised zones all of which have been mapped and sampled.

Historical Results

Historical drilling results are listed below. Typical intersections are generally:

- High grade: 1-2m @ 25-50 g/t Au + 150 g/t Ag + 5% Zn

- Lower grade: 2-5m @ 2-10 g/t Au + 20 g/t Ag minimal Zn

Mineralisation remains open in most directions and the continuity of mineralization across the property is yet to be tested by systematic drilling. A number of step out opportunities have been identified as illustrated below which will be tested in the initial drilling program.

Foreign Estimates (Non-JORC)

La Mancha completed two tonnage and grade estimates in 2003 and 2006. The reported 2003 NI43-101 (non-JORC Code compliant) resource estimate for the Hualilan project is a measured resource of 299,578 tonnes averaging 14.2 grams per tonne gold plus an indicated resource of 145,001 tonnes averaging 14.6 grams per tonne gold plus an inferred resource of 976,539 tonnes grading 13.4 grams per tonne gold representing some 647,809 ounces gold. (Source La Mancha resources Toronto Stock Exchange Release May 14, 2003 – Independent Report on Gold Resource Estimate)

These estimates are foreign estimates and not reported in accordance with the JORC Code. A competent person has not done sufficient work to clarify the foreign estimates as a mineral resource in accordance with the JORC Code. It is uncertain that following evaluation and/or further exploration work that the foreign estimate will be able to be reported as a mineral resource.

To verify the foreign estimates CEL in accordance with the JORC Code the Company intends to develop a program to include:

| Location | Category | (t) | Au (g/t) | Ag (g/t) | Gold Eq (Oz) |

| CERRO NORTE | Measured | 83,907 | 14.1 | 43.0 | 39,412 |

| CERRO SUR | Measured | 43,555 | 15.3 | 83.3 | 22,942 |

| MAGNATA VEIN | Measured | 172,843 | 12.8 | 44.6 | 74,357 |

| TAILINGS | Measured | 19,726 | 2.6 | 23.2 | 1,840 |

| TOTAL | Measured | 320,031 | 138,552 | ||

| CERRO NORTE | Indicated | 77953 | 14.1 | 43.0 | 36,616 |

| CERRO SUR | Indicated | 14,079 | 15.3 | 83.3 | 7,416 |

| MAGNATA VEIN | Indicated | 53,400 | 12.8 | 44.6 | 22,973 |

| TOTAL | Indicated | 145,432 | 67,005 | ||

| CERRO NORTE | Inferred | 394,600 | 13.2 | 167,772 | |

| CERRO SUR | Inferred | 477,362 | 14.7 | 225,646 | |

| MAGNATA VEIN | Inferred | 104,577 | 13.4 | 45,204 | |

| TOTAL | Inferred | 976,539 | 438,622 | ||

| GRAND TOTAL | 1,442,002 | 644,179 |

Table showing historical NI43-101 (non-JORC Code compliant) resource estimate

(Source La Mancha Resources Toronto Stock Exchange Release May 14, 2003 – Independent Report on Gold Resource Estimate)

These estimates are foreign estimates and not reported in accordance with the JORC Code. A competent person has not done sufficient work to clarify the foreign estimates as a mineral resource in accordance with the JORC Code. It is uncertain that following evaluation and/or further exploration work that the foreign estimate will be able to be reported as a mineral resource.

- Twinning of core holes;

- Additional data precision validation as required;

- Detailed interpretation of known mineralized zones;

- Geostatistical assessment of area of currently defined mineralisation to complete a re-estimation of these areas;

- Investigate further drilling requirements to upgrade both the unclassified mineralisation and mineralisation in the existing historical resources to meet JORC 2012 requirements;

- Structural interpretation;

- Metallurgical test work; and

- Complete a resource model review to meet JORC 2012 requirements.

Gold Application

Bullion

El Guayabo Project

Ecuador

The Andean Copper Belt contains multiple Tier 1copper/gold projects and half the worlds copper resources. Ecuador is emerging as host to world class copper and gold deposits and one of the most prospective and under portions of the Andean Copper Belt. A number of majors have made significant commitments to invest in Ecuador including BHP, Anglo, FMG, Hancock and Newcrest.

The Andean Copper Belt contains multiple Tier 1copper/gold projects and half the worlds copper resources. Ecuador is emerging as host to world class copper and gold deposits and one of the most prospective and under portions of the Andean Copper Belt. A number of majors have made significant commitments to invest in Ecuador including BHP, Anglo, FMG, Hancock and Newcrest.

El Guayabo Copper Gold Project

The project consists of nested late Oligocene to Early Miocene intrusions punctured and intruded by a number of breccia pipes and porphyries. Mineralization has been recognized in the breccia bodies, as quartz veins and veinlets which appear structurally controlled, and in the intrusives themselves.

The majority of the 33 historical drill holes intersected significant width of ore grade material including:

- 156m @ 2.6 g/t Au + 9.7 g/t Ag + 0.2% Cu

- 112m @ 0.6 % Cu +0.7 g/t Au +14.7 g/t Ag

- 116m @ 0.4% Cu + 0.6 g/t Au + 8.9 g/t Ag

- 215m @ 0.4% Cu + 0.2 g/t Au + 9.6 g/t Ag

The project has multiple targets:

- Additional high-grade breccia hosted mineralisation at depth – only 2 of the 10 known breccia bodies systematically sampled

- Extensive flat lying late stage vein system (1-2m at 10-20g/t Au) never drilled

- Porphyry system never tested at depth

Location and Access

The property is located within the El Oro Province of southern Ecuador, 35 Kilometers south southeast of the Machala (Ecuador´s fourth largest city) which lies on the Pan-American Highway and contains a world class deep water port.

Access to the property is excellent. The modern Santa Rosa Canton airport at Machala provides air services to Guayaquil and Quito daily. From the Santa Rosa airport access to the property is via paved road (18 km) and gravel road (5 km).

Exploration is uninterrupted all year round with the project located at only 1000m asl. A well-equipped active exploration camp, with a core processing and storage facility, exists at the site. This facility is capable of housing up to 20 workers and has electricity and phone/internet.

Geology and Mineralisation

Southern Ecuador is one of the most under-explored sections of the Andean Copper Belt, which extends from Chile in the south to Colombia in the north. This belt hosts some of the world’s largest porphyry copper and gold deposits.

Southern Ecuador is one of the most under-explored sections of the Andean Copper Belt, which extends from Chile in the south to Colombia in the north. This belt hosts some of the world’s largest porphyry copper and gold deposits.

Locally the El Guayabo project consists of a of metamorphic rocks intruded by a series of nested late Oligocene to Early Miocene Alkalic porphyry intrusions. The intrusions range in age from 40 – 10 Ma, suggesting a long-lived intrusive complex as is the case for much of western South America. The intrusions are the same age as those which host the Junin Porphyry copper deposit (982Mt @ 0.89% Cu), and identical in age and composition to those which host the Cangrejos (+10MOz Au) and Gaby (+10MOz Au) Projects some 10km and 40km along strike.

Mineralization has been recognized in:

- magmatic-hydrothermal breccia complex’s which are steeply emplaced and in the metamorphic host rock adjacent to the breccia

- quartz veins and veinlets which appear structurally controlled

- the intrusives themselves accompanied with disseminated pyrite and pyrrhotite and in the metamorphic host rock near the intrusions.

Favourable conditions to develop high grade mineralization at depth exist such as, development of a sealed system by older metamorphic basement, and amphibolite mafic lithology that could act as a sulphides trap (buffer). This favourable geology has acted as a focus for mineralisation in many know porphyry systems.

Exploration

Odin Mining and Newmont Mining were active in the Cangrejos – El Guayabo – Osos area beginning in 1992. From 1994 thru 1996, Odin and Newmont carried out a diamond drill campaign that culminated in 7,605 m of diamond core drilling. Kinross Gold Corporation was active in the district from 2006 to 2009 under a farmin agreement with Odin. Kinross’ work included geological mapping and soil and rock sampling. With the exception of an airborne magnetic survey over the property in 2000 no geophysics was undertaken.

Odin Mining and Newmont Mining were active in the Cangrejos – El Guayabo – Osos area beginning in 1992. From 1994 thru 1996, Odin and Newmont carried out a diamond drill campaign that culminated in 7,605 m of diamond core drilling. Kinross Gold Corporation was active in the district from 2006 to 2009 under a farmin agreement with Odin. Kinross’ work included geological mapping and soil and rock sampling. With the exception of an airborne magnetic survey over the property in 2000 no geophysics was undertaken.

This historical exploration appears to have been focused almost exclusively for gold targeting surface gold anomalies or the depth extensions of higher grade gold zones being exploited by the artisanal miners.

Historic geochemistry results (> 6000 samples) are representative of a typical porphyry copper zonation. The project presents two Cu-Mo-Pb zones, surrounded by outer halo with Au+Ag+Zn+Sb. This supports the evidence recognized in drill holes, that suggest that the magmatic-hydrothermal breccias are related to a porphyry copper source (Cu±Au±Mo system).

Historical Drill Results

The Historical drilling results are listed in the table below. The assay suite and follow up confirm that exploration appears to have been focused almost exclusively for high grade gold. The initial 5 drill holes were assayed for gold only and never followed or assayed for copper despite returning wide (+100m) intervals of 0.4 g/t Au with visible chalcopyrite logged in the core.

The Historical drilling results are listed in the table below. The assay suite and follow up confirm that exploration appears to have been focused almost exclusively for high grade gold. The initial 5 drill holes were assayed for gold only and never followed or assayed for copper despite returning wide (+100m) intervals of 0.4 g/t Au with visible chalcopyrite logged in the core.

Most holes have a significant intersection suggesting there is considerable potential to extend the known mineralisation. (SRK Consulting- High level review of the El Guayabo and Hualilan projects 27 July 2018).

A review of the historical drilling has indicated that many of the holes terminated prior to target and a number ended in ore grade mineralisation which was never followed-up. Only two of the ten known breccia bodies on the property have been systematically drilled and sampled.

Since gaining control of the project CEL has implemented a program designed to better define targets for drilling. The current program is underway:

- Re-logging of all available drill core as alteration, controls on mineralisation and mineral assemblages had not been consistently logged.

- 162 km soil geochemisty and MMI survey has been undertaken.

- A 3D MT survey which covers 162 Two lines of DC resistivity, induced polarization (chargeability) data acquisition will also be collected. The survey has been designed to image the existing breccia bodies (and their depth extensions), new breccia bodies, and to define porphyry targets to a depth of 1.5 km. Only widely spaced airborne magnetics has previously been done over the property.

- Surface and underground sampling including channel sampling of the adit and artisanal workings (> 1km of underground exposure of the system which has never been systematically mapped or sampled) and sampling of additional breccia bodies.

Copper Application

Power for Industry

Karoo Basin Gas Project, South Africa

A world class shale gas play

- 95% interest via subsidiary in an application for a permit to explore 3,500km2.

- World class shale gas province ranked eighth largest basin for shale gas reserves globally.

- Karoo Basin recoverable resource estimated at 390 trillion cubic feet (tcf) (US EIA, June 2013).

- Challengers’ application is centered on the 1968 discovery well.

- Only other applicants in the fairway are Shell and Chevron.

Geology

The Karoo Basin, which extends across 600,000km2 is located in central and southern South Africa and contains organic rich shales of Permian age with combined thickness up to 5,000 feet. The focus for shale gas exploration is in the southern portion of the basin where the shales are at sufficient depth and where five wells, all pre-1970, intersected the shales with significant gas shows. One well, the Cranemere CR 1/68 well, flowed more than 8 MMcf/day of natural gas from the Fort Brown shale during testing over a 158 feet interval in 1968. The production was judged to be from fractures and secondary porosity in the shales. As first mover, Challenger’s South African subsidiary, Bundu Gas and Oil Exploration (Pty) Ltd (Bundu), selected its application area of approximately 1 million acres to be centred around this well.

The Karoo Basin, which extends across 600,000km2 is located in central and southern South Africa and contains organic rich shales of Permian age with combined thickness up to 5,000 feet. The focus for shale gas exploration is in the southern portion of the basin where the shales are at sufficient depth and where five wells, all pre-1970, intersected the shales with significant gas shows. One well, the Cranemere CR 1/68 well, flowed more than 8 MMcf/day of natural gas from the Fort Brown shale during testing over a 158 feet interval in 1968. The production was judged to be from fractures and secondary porosity in the shales. As first mover, Challenger’s South African subsidiary, Bundu Gas and Oil Exploration (Pty) Ltd (Bundu), selected its application area of approximately 1 million acres to be centred around this well.

The US Energy Information Administration (EIA) updated its 2011 report on World Shale Gas Resources in June 2013. The EIA estimates that the Lower Permian Ecca Group shales in the Karoo Basin contain 1,559 Tcf of risked shale gas in-place, with 390 Tcf as the risked, technically recoverable shale gas resource.

The Opportunity

Challengers 95% owned subsidiary Bundu has lodged an application for the Cranemere project, a significant shale gas prospect located in the Eastern Cape Province. The application covers 3,500km2 (870,000 acres) centred on the 1968 discovery well.

The Karoo Basin has become the focus of intense interest in the past few years, following the initial application to explore for shale gas in the basin by Bundu (acquired by Challenger in April 2010) in February 2009. Furthermore, the low economic growth rates and power crisis in South Africa have strongly motivated the government to pursue potential shale gas resources as a catalyst to transform the economy.

Shell and Falcon Oil and Gas are also pursuing exploration rights in the region. Chevron has announced an Agreement with Falcon Oil and Gas Ltd to jointly co-operate on unconventional gas opportunities in the Karoo Basin, with the result that Challenger is the only junior company with interests in the basin, alongside Shell and Chevron.